Table of ContentsGet This Report about Why Reverse Mortgages Are A Bad IdeaFascination About Why Reverse Mortgages Are A Bad IdeaReverse Mortgages How They Work Can Be Fun For EveryoneThe Ultimate Guide To How Do Escrow Accounts Work For MortgagesFascination About How Many Mortgages Can You Have At One Time

With a lot of reverse mortgages, you have at least 3 business days after near cancel the deal for any factor, without penalty. This is known as your right of "rescission." To cancel, you need to alert the loan provider in writing. Send your letter by qualified mail, and request for a return invoice.

Keep copies of your correspondence and any enclosures. After you cancel, the lending institution has 20 days to return any money you have actually paid for the financing. If you presume a scam, or that somebody associated with the deal may be breaking the law, let the therapist, lender, or loan servicer know.

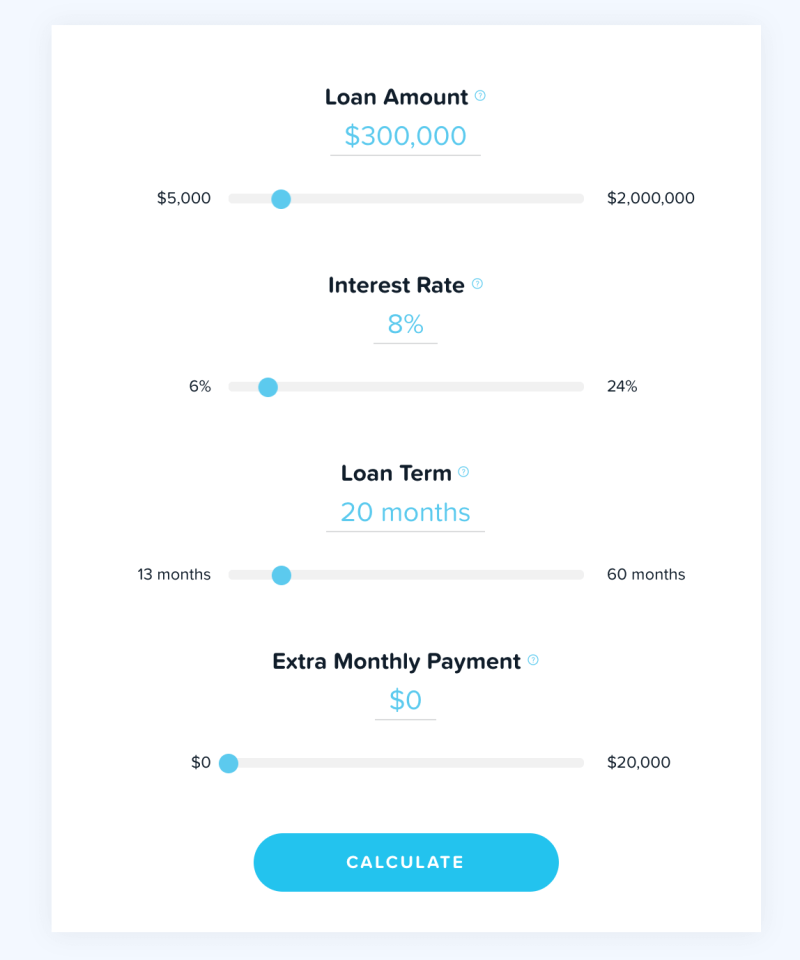

Whether a reverse home mortgage is right for you is a huge concern. Think about all your alternatives. You might qualify for less costly options. The following companies have more details: 1-800-CALL-FHA (1-800-225-5342) 1-855- 411-CFPB (1-855-411-2372) 1-800-209-8085. A fixed rate home loan needs a regular monthly payment that is the exact same amount throughout the term of the loan. When you sign the loan papers, you concur on an interest rate which rate never ever alters. This is the finest kind of loan if interest rates are low when you get a mortgage.

If rates increase, so will your home mortgage rate and monthly payment. If rates increase a lot, you might be in huge trouble. If rates go down, your home mortgage rate will drop therefore will your monthly payment. It is usually safest to stick to a set rate loan to protect against rising interest rates.

The What Are Mortgages Ideas

The amount of money you obtain impacts your rate of interest. Mortgage sizes fall into two main size categories: conforming and nonconforming. Conforming loans fulfill the loan limit guidelines set by government-sponsored home loan associations Fannie Mae and Freddie Mac. Non-conforming loans consist of those made to customers with poor credit, high financial obligation or current personal bankruptcies.

If you desire a house that's priced above your regional limit, you can still receive an adhering loan if you have a big enough deposit to bring the loan amount down below the limit. You can reduce the interest rate on your home loan by paying an up-front charge, referred to as home mortgage points, which subsequently lower your regular monthly payment.

In this way, buying points is said to be "buying down the rate." Points can likewise be tax-deductible if the purchase is for your primary house. If you plan on living in your next home for at least a years, then points may be a good option for you. Paying points will cost you more than just at first paying a greater rates of interest on the loan if you prepare to offer the property within just the next few years.

Your GFE likewise consists of a quote of the overall you can expect to pay when you close on your house. A GFE assists you compare loan offers from various lending institutions; it's not a binding contract, so if you decide to decline the loan, you will not have to pay any of the charges noted.

Reverse Mortgages How They Work Can Be Fun For Everyone

The interest rate that you are priced quote at the time of your home loan application can alter by the time you sign your mortgage. If you want to prevent any surprises, you can spend for a rate lock, which commits the lender to giving you the initial interest rate. This warranty of a set rates of interest on a home mortgage is just possible if a loan is closed in a defined time duration, generally 30 to 60 days.

Rate locks can be found in different forms a portion of your home mortgage quantity, a flat one-time cost, or just a quantity figured into your rates of interest. You can lock in a rate when you see one you want when you initially make an application for the loan or later in the procedure. While rate locks normally prevent your rates of interest from increasing, they can also keep it from decreasing.

A rate lock is worthwhile if an unexpected boost in the interest rate will put your home loan out of reach. If your deposit on the purchase of a house is less than 20 percent, then a lender may require you to spend for private home loan insurance coverage, or PMI, since it is accepting a lower amount of up-front money towards the purchase - what are subprime mortgages.

The cost of PMI is based upon the size of the loan you are looking for, your down payment and your credit rating. For instance, if you put down 5 percent to acquire a home, PMI might cover the additional 15 percent. If you stop paying on your loan, the PMI triggers the policy payment as well as foreclosure procedures, so that the loan provider can reclaim the house and offer it in an attempt to gain back the balance of what is owed.

Some Known Details About What Credit Score Model Is Used For Mortgages

Your PMI can likewise end if you reach the midpoint of your benefit for https://diigo.com/0icdmj instance, if you take out a 30-year loan and you total 15 years of payments.

Put simply, a home loan is the loan you get to spend for a home or other piece of genuine estate. Offered the high expenses of buying property, practically get out of a timeshare every home buyer needs long-term financing in order to purchase a home. Generally, home loans include a fixed rate and make money off over 15 or 30 years.

Home loans are property loans that feature a defined schedule of repayment, with the purchased residential or commercial property functioning as collateral. In many cases, the customer must put down in between 3% and 20% of the overall purchase rate for the home. The rest is offered as a loan with a repaired or variable rates of interest, depending upon the kind of home loan.

The size of the deposit might also affect the quantity needed in closing fees and regular monthly home loan insurance payments - how do reverse mortgages work. In a process called amortization, the majority of mortgage payments are split in between paying off interest and minimizing the primary balance. The portion of principal versus interest being paid each month is computed so that primary reaches absolutely no after the final payment.

Some Of What Banks Do Reverse Mortgages

A couple of home mortgages permit interest-only payments or payments that don't even cover the full interest. Nevertheless, people who prepare to own their homes should opt for an amortized home mortgage. When you go shopping for a house, understanding the common kinds of home loans and how they work is simply as crucial as discovering the ideal house - which type of credit is usually used for cars.

In other cases, a new mortgage may assist you reduce payments or pay off faster by refinancing at a lower rate. The most popular home mortgages use a set rate of interest with repayment terms of 15, 20 or 30 years. Fixed rate home loans use the warranty of the same rate for the entire life of the loan, which implies that your month-to-month payment won't increase even if market rates go up after you sign.